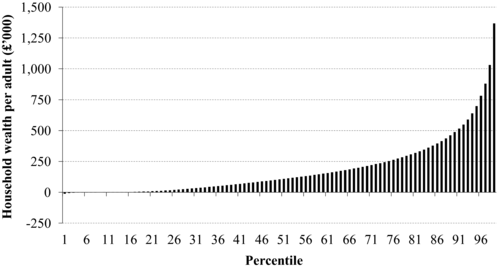

The Institute of Fiscal Studies says that “..wealth is distributed very unequally. One per cent of households have negative net wealth of greater than £12,000 per adult (the 1st percentile), while the 9th percentile is £0 so 9 per cent of households have no positive net wealth. Wealth at the median is £104,000 per adult. Wealth at the very top increases dramatically across a small number of percentiles – the 95th and 99th percentiles are £0.7 million and £1.4 million per adult respectively. In fact, the estimates of wealth held at the very highest percentiles could be underestimates;”

There is no problem with saving your income to increase your wealth. But there is a problem when inherited wealth means that those who have not had the good fortune to have wealthy parents or ancestors are denied the chance to ‘better’ themselves.

This is more than an academic problem. For example, for most people, the biggest expenditure is housing. If you look at how much you can borrow, and at typical house prices then two-thirds of people cannot buy a home without help from someone who has wealth. The graph above shows that perhaps a third of the population have insufficient wealth to avoid the having to enter the private rental market. The high cost of renting means they have less chance of building themselves a better future – the rules are stacked against them.

That is why it is right to reverse the increase in Inheritance Tax threshold, we need to even out the playing field.