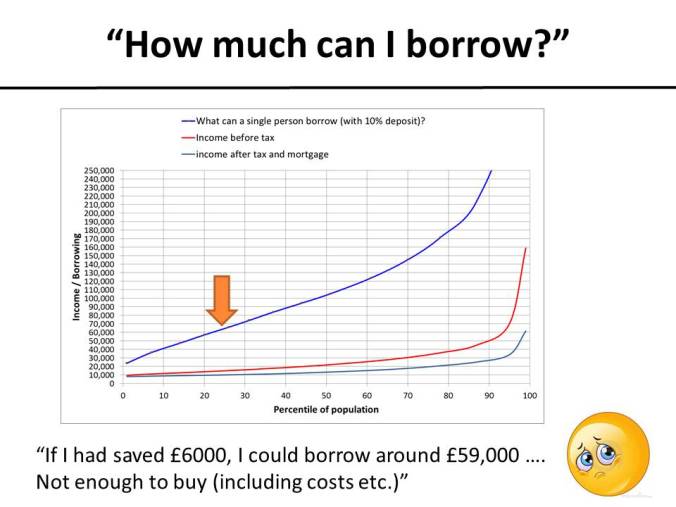

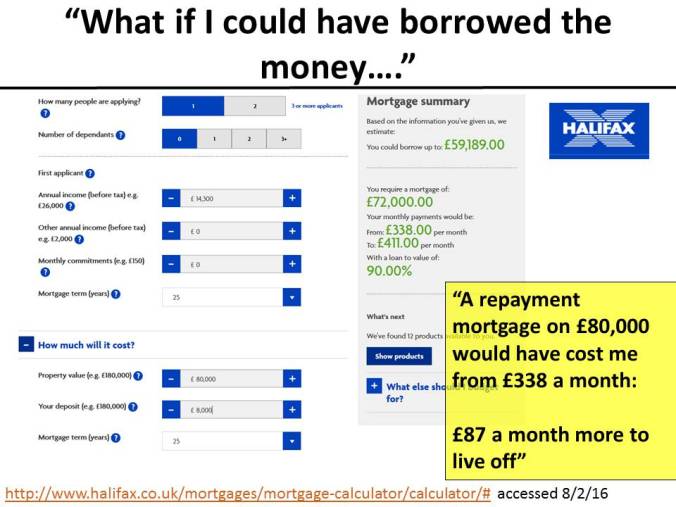

The chart below shows the income distribution in the UK (latest figures available from government statistics) and the corresponding amount that you can borrow if you have a 10% deposit (using the Halifax building society mortgage calculator).

Two thirds of the working population would be earning too little to buy a house for £150,000 by themselves. If you do not have the ‘bank of Mum and Dad’ then you have no chance.

Your only option is to rent, from the private sector, at a cost that is higher than your mortgage repayments would be if you were able to get a loan.