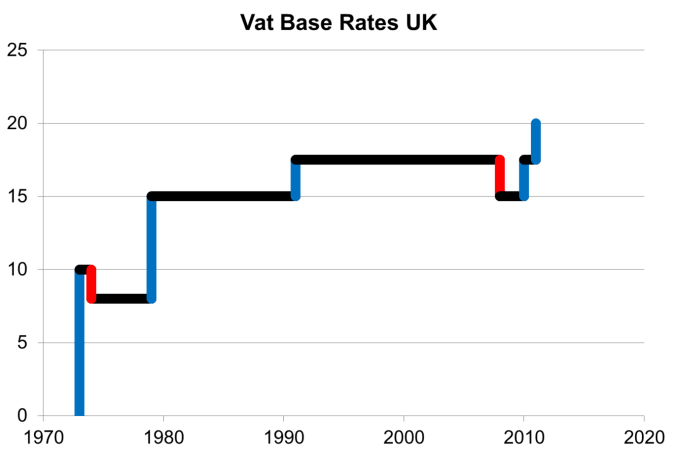

VAT is a tax on what we spend. Everybody has to pay VAT at the same rate, rich and poor alike. The following chart shows which parties have changed the basic rate of VAT since its introduction by the Conservative government on 1973.

Increasing VAT puts a bigger burden on the poor than the rich, as shown by the following analysis of the most recent VAT risk from 17.5% to 20%:

Reducing the rate of VAT will ease life for the less well off, increase sales, increase business activity and lead to higher employment. That will increase income and corporation tax revenues and reduce the cost benefit payments as there will be less people out of work.

It is time to cut VAT, not to consider increasing it.